- Home

- Customer Service

- Payment

Customer Service

Opening hours Megastore

| Monday | 8:30 - 17:00 |

| Tuesday | 8:30 - 17:00 |

| Wednesday | 8:30 - 17:00 |

| Thursday | 8:30 - 17:00 |

| Friday | 8:30 - 17:00 |

| Saturday | 10:00 - 16:00 |

| Sunday | Gone Kiting |

*Customer Service is closed on Saturdays.

*Different opening hours apply on public holidays.

Payment

Below you will find all information regarding payment, such as what payment methods we offer, how to arrange a VAT refund if you export your products outside the EU or how to redeem a Kitemana Gift Card. If you can't find the answer to your question, please check the FAQ or contact us.

-

The available payment methods vary by country. In the check-out you will see the available payment methods after choosing the delivery country. Your order will be shipped after we have received your payment.

In the Kitemana Megastore you have the following choices for payment method: cash, pin, credit card (AMEX, VISA, Mastercard), Kitemana Gift Card or Sports Gift Card.

-

- Prices on our website within the EU are displayed including VAT.

- Prices on our website outside the EU are displayed excluding VAT. Thus, for customers from non-EU countries (e.g. Switzerland, England, Norway, United States and Japan), VAT is automatically deducted from the total price. Please note that VAT of delivery country + import taxes will be charged to you by UPS before delivery via a payment link in the tracking. So keep a eye out on your tracking.

- The correct display of prices on the website are determined by the delivery country. In the header you can change the delivery country to see the price in the right currency and VAT display. Price displays in currencies other than Euro are updated daily to the recent exchange rate. The final settlement is always in Euros.

CAUTION: Always inform yourself well to avoid unexpected import costs. It is not possible for us to keep track of all customs regulations around the world. Kitemana is not responsible for additional VAT, import and customs fees.

-

Do you buy a product from our store and are you going to export this product to a country outside the EU? Then you have the opportunity to reclaim the VAT, if you meet the following conditions:

Conditions to qualify for VAT refund:

- The invoice value including VAT is € 150,- or more;

- Your order is delivered within the EU;

- You can prove that you live outside the EU;

- Your billing address is your residential address abroad;

- You export the products yourself outside the EU;

- You export the products within 3 months of purchase;

- Have your Kitemana invoice stamped by customs, proving the gear left the EU;

- You need to send the original paper invoice, together with a copy of your passport and your IBAN number in your name, to Kitemana.

How can you arrange a VAT refund through Kitemana?

We will need from you:

- The original invoice with a customs stamp;

- A copy of your passport;

- An IBAN number on your name with SWIFT/BIC code.

You need to send the original stamped invoice to:

Kitemana B.V.

Keyserswey 67

2201 CX Noordwijk

the Netherlands

You need to send the original stamped invoice to:IMPORTANT:

- Only if all conditions are met, we can provide the VAT refund as a service as explained above. However, no rights can be derived from this.

- The responsibility for obtaining the stamp at customs does not lie with Kitemana. In case customs did not issue a stamp, often because the procedure was not properly followed, we cannot help further or issue a refund. Therefore, please read carefully which rules apply to you.

- Only a stamped original invoice will be accepted. Stamped order confirmations, packing slips or other documents cannot be processed.

- We also cannot process scanned documents.

We have listed some important websites for you below:

-

At Kitemana, you can be sure you'll never pay too much. Every day we check the market prices of kites, boards and accessories. If prices are lower somewhere else, we will adjust our prices on the spot. Kitemana offers a daily best price guarantee.

Accidentally seen a product for a better price? Send us a message with proof of the offer, and we'll consider matching the price.

Conditions for the best price guarantee:

- The product must be completely comparable. So brand, product, type, etc. must match exactly.

- Second-hand products are excluded.

- The (web) store has a mention of Chamber of Commerce and/or VAT number.

- The product must be immediately available at the competition.

- The product must be supplied with equal terms of delivery.

- Indicate where you came across this product and for what price.

- A price match does not apply in retrospection. So after having placed your order, no claim can be made on this arrangement.

-

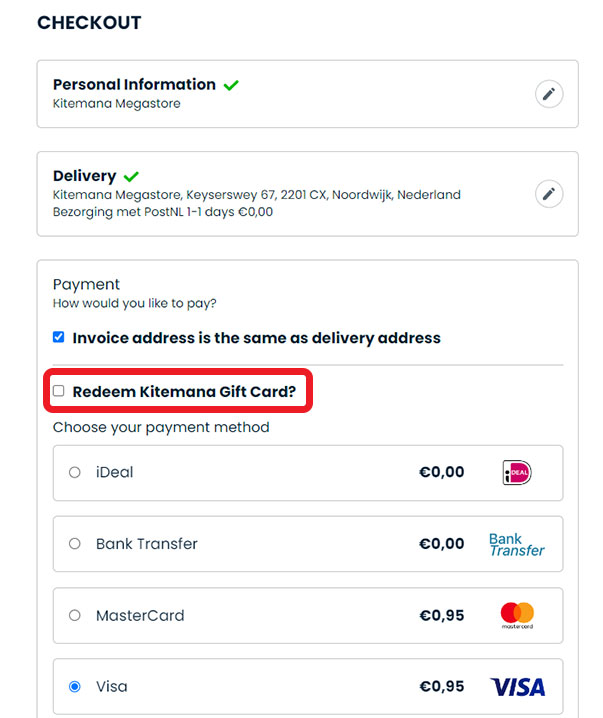

How can I redeem a Kitemana Gift Card?

Your friends have taste! You have received a Kitemana Gift Card and you want to use it with your next purchase. Please read below how you can redeem your Gift Card.

- The code on the card can be redeemed both online and in our Megastore in Noordwijk.

- Online you do this by entering the code in the CHECK-OUT at the Payment option in the activation code field.

- Enter the code and activate it with the button. The amount will now be deducted from your purchase.

- Should the value of the gift certificate not be fully spent on your purchase, the outstanding amount will remain valid on the card.

-

Conditions

- A Gift Card is valid for 2 years;

- A Gift Card is not redeemable for cash;

- A Gift Card cannot be returned;

- The value of the Gift Card will be deducted from the outstanding invoice and does not relate to a specific offer or item.

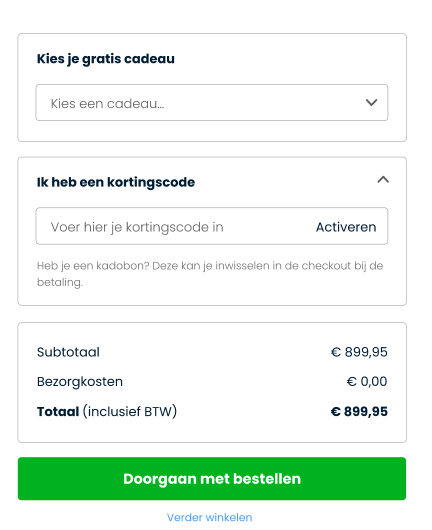

PLEASE NOTE: A Gift Card is redeemed when you end up in the CHECK-OUT at Payment. A discount code, on the other hand, you enter before you Continue Ordering.

Where can I order a Kitemana Gift Card online?

Want to surprise someone with a Kitemana Gift Card? You are a good mate! Order your Gift Card here. -

Kitemana regularly issues a discount code for temporary deals.

These discount codes are announced through the website, newsletters and social media. Don't want to miss any promotions? Then join our newsletter here and follow us on social media!

How do I activate a discount code?- The discount code can be used online or in our Megastore in Noordwijk.

- Online you can enter the discount code in the CHECK-OUT. If you click on Discount Code you will get an input field.

- Enter the code and activate it with the button. The discount amount will now be deducted from the specific product.

-

Conditions:

- Discount codes are valid temporarily;

- Discount codes often apply to specific products;

- Discount codes may depend on the country;

- Discount codes are usually standalone and cannot be used together with other discount codes;

- Discount codes may be unique to 1 person.

Frequently Asked Questions

We've listed our answers to the most frequently asked questions for you below. Is your question not answered? Please contact our Customer Service. We are available from Mon-Fri between 08.30 - 17.00 for all your questions via email, WhatsApp or phone: +31 (0) 71 40 811 54.

-

If you still want the product and it is also still available, you can simply place a new order. We will automatically cancel the previous order.

- If you pay by credit card and your order value is high, there may be a limit (for your own security) on the amount you can spend at once. You can often easily change this by contacting the credit card company or in your bank's App.

- If you are paying by credit card from a country outside of Europe, the transaction may not be completed (for security reasons). Make sure you are allowed to make payments in Europe. You can easily change this by contacting the credit card company or in your bank's App.

-

Yes, you surely can.

1. As a business customer in the Netherlands, you can fill in the invoice details with your company name during the payment process. You can reclaim the VAT through the local tax authority, called the Belastingdienst.

2. As a business customer outside the Netherlands, you can order on the basis of a intra-community supply of goods without VAT. Read more about the conditions on the latter website.

If you want, we can register a business account for you. Please follow the procedure below:-

Send us an email from your business email (i.e. no Gmail, Hotmail, Outlook, etc.) containing:

- - a VAT-number;

- - Chamber of Commerce number;

- - Company name;

- - Business address.

- We will then verify your business details. If everything is correct, we link back to you so you can order VAT-free from our webshop.

-

Send us an email from your business email (i.e. no Gmail, Hotmail, Outlook, etc.) containing:

-

All payments are processed in Euros. Please select your own currency on our website, so that you know well what the final cost will be. The currency rate is updated once a day to the current day rate. So you may see small differences per day. At the moment of payment your currency will be converted back to Euros and you will see the amount in Euros that will eventually be paid to us.

-

If you return a product to us, the return and refund will be processed within 7 business days. The refund will be made to the same account number, credit card or PayPal account with which the payment was made. Depending on the payment method, it may take a few days before the money is visible in your bank account again.

-

VAT stands for Value Added Tax, also known as 'sales tax' in the US. VAT FREE or EX. VAT means that orders are shipped to the delivery country exclusive of VAT. This is only possible to countries outside the EU. The price is 100% for the order.

A country can charge import tax and/or import fees on the order amount. This is calculated on the order amount. Make sure you are aware of the local tax regulations if you have an order delivered outside the EU. We have worked this out for a number of countries. Check our Delivery page, in the table if you select the country. -

All online payments are handled by MultiSafepay or PayPal. Online payment details are transmitted directly to the payment platform via a secure Secure Socket Layer connection (SSL). Once the payment is approved, Kitemana receives notification that the payment has been processed. The order will then be shipped by Kitemana to the address provided.

If credit card is chosen as payment method, the terms and conditions of the respective card issuer apply. Kitemana is not a party in the relationship between you and the card issuer.

-

- Pay in the Megastore: hand over your Sports Gift Card at checkout, the amount on your Sports Gift Card will be deducted from your total amount. If necessary, you can pay off the remaining amount in another way.

- Online payment: in the checkout, choose Sports Gift Card as payment method. Enter your card number and security code and the amount on your gift card will be deducted from the total amount. The remaining amount can now be paid in another way, for example with iDeal.

Added to basket

| Subtotal | € 0,00 |

| Shipping costs NL | € 0,00 |

| Total (incl 0% VAT) | € 0,00 |

You have no product(s) in you basket.

Weet je niet waar je moet beginner?

Contact our customer service for advice